Here are a few tips on how you can begin Investing in stocks, which is a great way to diversify your investments portfolio.

Stock investing used to be an alien concept to me but I tried to learn as much as I can about it because I wanted to diversify my knowledge in money, finance, and investments.

How I Began Investing In Stocks Through COL Financial

All about investing in stocks

For those who are not experts like me, investing in the stock market, in a way, is buying ownership of a business entity. So even if you are a small-time investor who buys 100 shares from BPI, you are already a part-owner of that bank although on a tiny-scale.

That is the simplest way to put it. Remember, the amount of shares you buy, the bigger your possible earnings in the future.

You earn two ways: by selling your shares when its value appreciates or goes higher, and through dividends paid out by the company when business goes well and becomes profitable.

Of these two, the first one guarantees better and faster earnings but you have to diligently monitor the value of your stocks, which can move on a daily basis. This is the preferred method of aggressive investors. They buy stocks, sell them for profit, then buy more stocks.

Honestly, I have not sold any stocks yet because I am not too diligent in monitoring my investments. I might sell some stocks in the future when their value goes high, which is most often guaranteed for premium or blue chip companies (think of Jollibee, SM, BDO, and Ayala Corporation, just to name a few), but I am contented at the moment with the thought that I have cash to liquidate from stocks.

Again, that is just my preference. But if you ask me, I would urge you to be more aggressive so that you can make your money work and earn from your investment.

My personal stock investing journey

I began to be interested in stock investing more than a decade ago. I wanted to invest my money somewhere safe and promised good returns. A colleague suggested stocks but I did not know where to begin.

My company that time had a stock brokerage subsidiary so my most natural instinct was to approach it in hopes of buying stocks from our company. When I asked a stock broker on how to go about it, I was told that it was as simple as opening a bank account, which meant filling out a form paying the fee for the equivalent number of shares which is usually 100 stocks plus other fees and charges related to facilitating the deal.

However, when I was presented a computation of the total sum that I had to pay it amounted to around P30,000. That was a huge amount of money during that time and I was not ready to shell out that much.

Plus, I thought that I was not even 30 years old so why even bother to rush? Wrong! I should have gone for it and started early but that warrants another story.

On choosing COL Financial

Finally, after a decade or so, I finally convinced myself to invest in stocks again. I asked three colleagues what stock brokerage firm they would recommend and they all said COL Financial.

Aside from my colleagues’ recommendation, what really got me interested in COL Financial was the low investment amount of P5,000, the easy-to-navigate dashboard, and the free seminars that it offers.

So when I learned that I only had to shell out P5,000, I readily checked COL Financial’s website, downloaded the account opening form, fill out the necessary details, made a copy of my two valid IDs, and went to its branch nearest my office.

After my initial interview at the COL Financial office, my account was approved and was provided with login credentials for the dashboard. In order to pay the P5,000 initial investment, I had to enrol COL Financial as a biller in my online banking account. The P5,000 will be reflected in your COL Financial dashboard upon payment. You can then use this to buy your first 100 stocks.

To add more money to your COL Financial account, just login to your online banking account, click “Pay Bills,” choose “COL Financial” from your list of registered billers and proceed to pay the amount that you want to invest in.

How to buy stocks in the COL Financial dashboard

With the advent of online banking, it's now much easier to conduct financial transactions including buying of stocks.

Here are the steps on how to buy stocks through the COL Financial online dashboard:

1. Login to your COL Financial account dashboard.

2. Click on the "Research" tab. From the sub-menu that will appear, click "Fundamentals," then "Investment Guide." The Investment Guide will display the list of stocks, stock codes, as well as prices.

3. From the Investment Guide, you may choose the shares that you can buy based on your buying power i.e. the amount in your account. Take note also that the minimum number of stocks that you can buy is 100. So, to see which company stocks you can afford, multiply 100 by the stock price then compare it to your buying power. If it's within your budget, then well and good.

4. Once you have decided on the stocks that you are interested to buy, remember the stock code and price because you will key these details in the next step.

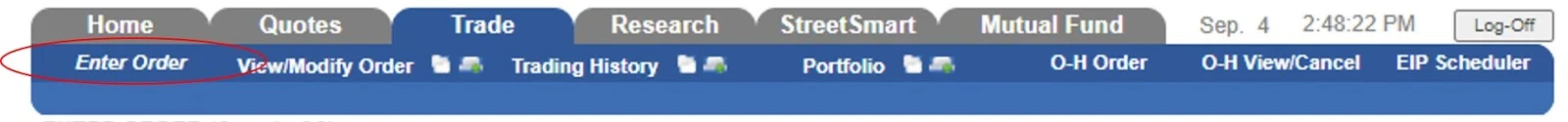

5. Now that you are ready to buy, click the "Trade" tab in the menu.

6. In the fields that will appear, you will be prompted to enter your order details, including the stock code, price, and number of shares.

7. Place your order and wait for the prompt that you were able to successfully buy your desired stocks.

How to sell your stocks

If you decide to sell your shares, you may also do this in the COL Financial dashboard. Just click the "Trade" tab, then click "Portfolio."

The list of stocks that you own will be displayed in a table. Choose “Sell” then proceed to fill out the details of the stocks that you are selling.

The list of stocks that you own will be displayed in a table. Choose “Sell” then proceed to fill out the details of the stocks that you are selling.

Lastly, remember the trading cut-off time or the period in which you can only buy and sell stocks.

COL Financial branches and contact details

For more information about COL Financial, its website, https://www.colfinancial.com/, is full of many useful information.

If you prefer to go talk to any COL Financial representative, you may visit any of the following branches or call their respective telephone numbers:

COL Business Center

2403B East Tower,

Philippine Stock Exchange Center,

Exchange Rd. Ortigas Center,

Pasig City 1605 Philippines

Mon - Fri, 8:30 AM - 5:30 PM

+632 86515888

COL Investor Center - Makati

Ground Floor, Citibank Tower,

Valero St. corner Villar St.,

Makati City 1227 Philippines

Mon - Fri, 8:30 AM - 5:30 PM

(+632) 84782954

(+632) 84783316

(+632) 84783275

COL Investor Center - Cebu

Unit B205 Axis Entertainment Ave.

Vibo Place, N. Escario St.

Cebu City, Philippines

Mon - Fri, 8:30 AM - 5:30 PM

(+6332) 261-8601

(+6332) 261-8615

(+6332) 261-8624

COL Investor Center - Davao

2nd Floor Robinsons Cybergate,

J.P. Laurel Ave., Bajada,

Davao City, 8000 Philippines

Mon - Fri, 8:30 AM - 5:30 PM

(+6382) 287 8192

(+6382) 287 8193

(+6382) 287 8194

COL Investor Center - Ilocos

Level 2, Unit 242 Robinsons Place Ilocos Expansion Mall,

Brgy. 1, San Nicolas, Ilocos Norte

Mon - Fri, 8:30 AM - 5:30 PM

(+6377) 677 3445

(+6377) 677 3443

(+6377) 677 3442

Epilogue

Investing in stocks may sound complicated and sophisticated at first but it is fairly simple once you get the hang of it. Much of the work actually involves consistent monitoring of the stock prices in order for you to see which shares you can already sell.

If you are treating your stocks as long-term investment, you can also opt to keep them in the long run because their prices are bound to appreciate in the future.

Also read: How to use credit cards to your advantage

This post may contain affiliate links, including those from Amazon Associates, which means that if you book or purchase anything through one of those links, we may earn a small commission but at no extra cost to you. All opinions are ours and we only promote products that we use.

Download a free copy of my Churches of Nueva Ecija eBook HERE!

This is something I've toyed with for a while. I wish I had gotten into stock investing when everything crashed during Covid. I think I'll probably make the leap when the next big opportunity arises. Great to read your experience.

ReplyDeleteThank you for sharing your personal stock investing journey. I’ve been curious about this aspect of a financial portfolio. The COL financial dashboard makes this venture more approachable.

ReplyDeleteVery useful. I agree that investing from a young age is the way to go. Unfortunately, I wish I had started earlier in my investing journey as well. Another mistake I did was panic selling whenever there was a scare.

ReplyDeleteStill, I have managed to maintain a couple of SIPs, I also have some stocks, real estate, and insurance. Fingers crossed, I can continue to increase my investments.

COL sounds like it's a great help in investing. Investing can be lucrative, but you have to know what you're doing. You need help to do that.

ReplyDeleteI'd definitely use COL if I were in the country. It sounds like an excellent tool to help make investing easier.

ReplyDeleteI have been a stock investor for about 20 years. The internet has made investing easier than ever before!

ReplyDeleteWhen making an investment decision it is extremely important to put together as many facts as you possibly can. You do not want to make a mistake.

ReplyDeleteI have been thinking of starting some investing. It is nice to have this information.

ReplyDeleteCOL sounds like an excellent platform for investing. I love the low fees, easy interface, and available education to help you succeed.

ReplyDeleteAaahhhh...thank you for sharing the contacts of the stock brokers available there! I will check them out. Stock investing is a good way of buying yourself some money, for your future! I highly recommend it.

ReplyDeleteI love the affordability and educational opportunities afforded by COL. It sound slike an excellent platform.

ReplyDeleteinteresting.. i know someone who's using COL also.

ReplyDeleteI would love to invest in this but I still need to have more time learning about this.. Maybe after my bout for the bar exams.. ;)

Great tips for investing. I love that you broke it down into steps.

ReplyDeleteStocks are good investment option. You are guaranteed a huge ROI if you are good in forecasting but that entails a lot of time .

ReplyDeleteThankfully my husband knows a ton about stocks because I do not lol

ReplyDeleteThat's good that you had recommendations to get back in. I'm sure it can be fun.

ReplyDeletebeen hearing COL Financial for a long time now, my friends were into stocks too. I can attest this institution is one of the pioneers in stock market in the phil

ReplyDeleteWow! I'll try this. We all need to invest especially at this time where the economy is a bit unstable.

ReplyDeleteHey! Same here! I'm on COL Financial. Lately my stocks performance are erratic. But still with a gain.

ReplyDeleteHey! Same here! I'm on COL Financial. Lately my stocks performance are erratic. But still with a gain.

ReplyDeleteThanks for sharing this tips mommy and daddy sobrang worth it po basahin at sobrang laking tulong din po tlga, lalo na sa mga nagssimula plang mag Invest.. this is really amazing

ReplyDeleteInvesting in stocks needs a lot of monitoring. I have known people who earn so much by putting their money on stocks. Just be careful though, in selecting the company that you want to buy shares with. sometimes, it is a bit risky. https://www.thecityrat.com

ReplyDeleteOne of the Best Blog na nabsa Ko.. Sobrang Laking Tulong Specially sa mga Gstong Magsimulang Mag Invest 💕💕 thanks for sharing this mommy and Daddy 🙏

ReplyDeleteYou are welcome po. Sana po ay makapag-invest din po kayo sa stock market. Hindi need ng malaking capital to start investing unlike before.

ReplyDeleteYes, sir. It's a good thing that COL Financial has an investment guide that contains their recommended stocks to buy.

ReplyDeleteThank you po. Sana masubukan nyo din mag-invest sa stocks.

ReplyDelete