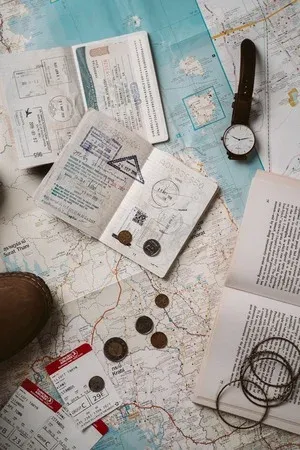

Here are some of the most common money mistakes to avoid when traveling abroad.

Frequent travelers know how tricky money can be when traveling abroad.

Should you carry a huge wad of cash or charge all purchases to your credit

card? Wrong decisions can make you spend more than you intended.

|

| Photo by Taryn Elliott |

7 Common Money Mistakes to Avoid When Traveling Abroad

Lifestyle vlogger Jennie Ver Gabon, a wanderer at heart who currently works in

Japan, shares some tips to avoid costly money mistakes when traveling.

1. Exchanging money at the airport

Airport exchange kiosks aren’t the best place to get local currency as they

often have less favorable exchange rates and higher conversion fees. Instead,

exchange your money before you leave home, so you have enough time to shop

around for the best rate. You can call your bank to know if they offer foreign

currency exchange services.

2. Failing to plan ahead for your local transport

Not researching the airport’s distance to your hotel and your transportation

options can slash a huge chunk off your budget. You might end up taking taxis,

which are notorious for overcharging tourists. Look up how the train or bus

system works in your travel destination. Your hotel may also provide airport

shuttle services, so remember to call ahead.

3. Traveling without insurance

Lost luggage, accident claims, and flight cancellations are usually problems

that can be remedied by travel insurance. These emergencies are a headache to

deal with and can set you back thousands of bucks.

It’s better to invest in a comprehensive travel insurance for your peace of

mind, especially if you’re a frequent flyer. Getting a travel insurance that

covers expenses for medical emergencies is also highly recommended in this age

of COVID-19.

4. Using your debit or credit card

We all love our debit and credit cards for their convenience, but you have to

think twice about swiping when abroad. Depending on your bank and card, you

might be charged a foreign transaction fee of up to 3.5% for every purchase.

Probably not what you want to spend your travel budget on, right? So, check

your card issuer’s policies on offshore transactions before you leave.

5. Withdrawing from local ATMs

Withdrawing local currency from the ATMs in your destination could be a good

way to score decent exchange rates. Still, you have to be careful with service

charges and withdrawal limits. Call up your local bank before your trip to

inquire about international transaction fees and daily withdrawal limits so

you can plan accordingly.

6. Keeping all your cash in one place

Be careful with how much cash you carry and where you keep them when you’re in

another country. Tourists often fall prey to pickpockets and thieves because

of neglect. You don’t want a robber to ruin your vacation, right?

7. Exchanging leftover cash back to peso

If you still have some foreign currency left on your last day, you’re better

off spending it in duty-free shops instead of exchanging it back to peso. The

exchange rate to peso will probably be lower than the rate to the currency you

need. This means you’ll make the most of your money if you just spend it —

unless you have immediate plans to return to the same travel destination.

Say ‘Hello’ to Worry-Free Trips Abroad

Besides these seven common money mistakes, the best trick Ms. Gabon has

learned from all her travels is to use digital payments like e-wallets.

One of the e-wallets that support overseas payments is HelloMoney, which is

powered by Asia United Bank (AUB), one of the fastest-growing publicly listed

universal banks in the Philippines. Last November, AUB, in collaboration with

Alipay+ of the Ant Group, made the e-wallet available and accepted for use

initially in South Korea and Japan. This means traveling in these foreign

cities is now more convenient by saving you the hassle of exchanging your

money or carrying cash.

You can use the HelloMoney app in convenience stores, restaurants, and retail

shops, as long as the merchant accepts Alipay+. You can even pay for your

transportation expenses using HelloMoney since train systems in Japan and

South Korea, as well as some taxi drivers, are now Alipay+ partners.

HelloMoney is easy to use. All you have to do is scan the QR code at the

cashier and you’re done! Some merchants require you to generate a QR code,

which the cashier will scan with a barcode reader. Either way, the transaction

won’t take more than two minutes.

Other than digital payments, the e-wallet also lets you buy prepaid load,

remit money through PeraPadala, settle bills, and withdraw from an ATM.

AUB is also expanding HelloMoney’s market in other Asian countries so you’ll

be able to use it in other countries soon, too! For now, enjoy your HelloMoney

to go cashless in the lands of the rising sun and the morning calm.

This post may contain affiliate links, including those from Amazon Associates, which means that if you book or purchase anything through one of those links, we may earn a small commission but at no extra cost to you. All opinions are ours and we only promote products that we use.

Download a free copy of my Churches of Nueva Ecija eBook HERE!

Post a Comment